- OCBC Securities

- Promotions

Seize great trading opportunities with these great promotions

Enjoy low interest rates from just 4.00% p.a. with our Quality Priced Loan scheme, QPL+

Enjoy our enhanced Quality Priced Loan scheme, QPL+, with even lower interest rates starting from 4.50% p.a.

As an added benefit, you get to enjoy lower online commission rates across the 5 main markets.This promotion is valid till 31 December 2025.

Interest rates starting from 4.50% p.a.

| Quality of Marginable Securities | Description | SGD Lending Rates | USD Lending Rates | HKD Lending Rates | AUD Lending Rates | |

| Grade 1 | Major Global Index Component Securities | 4.50% | 5.70% | 5.50% | 5.25% | |

| Grade 2 | Top 100 securities by market capitalisation in respective exchanges that have met certain financial and trading criteria as determined by OCBC Securities | 4.80% | 5.90% | 5.75% | 5.50% | |

| Grade 3 | Mid/Small Cap Securities | 5.20% | 6.00% | 6.00% | 5.75% | |

| Grade 4 | All other Marginable Securities | 7.00% | 7.00% | 7.00% | 7.50% | |

Lower online commission rates with QPL+

Who is eligible?

This promotion is eligible to all existing Share Financing account holders and those who do not have a Share Financing account with us yet.

Existing Share Financing account holders

Simply complete the QPL+ Selection Form and mail it to us.

If you do not have a Share Financing account, open one with us

Download this Application Form, Memorandum of Charge form, as well as QPL+ Selection Form and mail them to us to open one.

Alternatively, you can visit our branch to open a Share Financing account:

OCBC Securities Investors Hub

18 Church Street

#01-00 OCBC Centre South

Singapore 049479What are the requirements to open a Share Financing account:

- Be age 21 and above

- Have an existing basic cash trading account with OCBC Securities

What is a Share Financing account?

A Share Financing account is a leveraged Trading Account that increases your share buying power. Trade up to 2.5 times your original value with shares as collateral and 3.5 times with cash as collateral. For more information on Share Financing accounts, click here.

What is the Quality Priced Loan scheme about?

With our first-to-market Quality Priced Loan scheme, you stand to enjoy lower interest rates based on the quality of securities in your portfolio starting from 4.50% p.a. with the new QPL+. To view our list of marginable securities and their grading, click here.

How are the interest rates calculated?

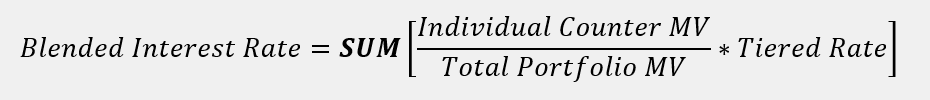

A blended Interest rate shall be calculated based on the relevant interest rates corresponding to the various grades and will depend on the concentration of Marginable Securities customer holds from each tier.

Marginable value of the customer’s portfolio as at previous business day, including all outstanding trades will be used for the computation of the interest rates daily.

The following examples illustrate how interest rates are computed based on the quality and marginable securities in the customer’s portfolio. The blended interest rate in each example is derived from the below formula.

Example 1

| Counter | Grade | MV of security | Tiered Rate |

| Company ABC (SGD) | 1 | S$100,000 | 4.50% |

| Company DEF (AUD) | 2 | S$20,000 | 5.50% |

| Company GHI (HKD) | 3 | S$10,000 | 6.00% |

| Total | - | S$130,000 | - |

Blended Interest Rate = 4.77% p.a.

Example 2

| Counter | Grade | MV of security | Tiered Rate |

| Company ABC (SGD) | 1 | S$100,000 | 4.50% |

| Total | - | S$100,000 | - |

Blended Interest Rate = 4.50% p.a.

Example 3

| Counter | Grade | MV of security | Tiered Rate |

| Company ABC (AUD) | 1 | S$50,000 | 5.25% |

| Company DEF (SGD) | 3 | S$50,000 | 5.20% |

| Company GHI (USD) | 4 | S$20,000 | 7.00% |

| Total | - | S$120,000 | - |

Blended Interest Rate = 5.52% p.a.

What happens when the promotion ends?

The normal QPL scheme will kick in when the QPL+ promotion ends. To view the normal rates, click here.

Important Notes

For full terms and conditions of Quality Priced Loan Plus promotion (“Promotion”), click here.

Borrowing to finance the trading of securities (leveraging/gearing) carries a high degree of risk. If the value of the collateral declines substantially, falling below the maintenance margin requirement, you may be called upon to deposit substantial additional funds or collaterals on short notice in order to maintain your position. If you fail to comply with a request for additional funds or collaterals within the specified time, your position may be liquidated at a loss and you will be liable for any resulting deficit in your account. Trading in foreign securities includes, but is not limited to, currency risks and rules and regulations peculiar to the respective foreign stock markets.

Customers should note that there are limitations and difficulties in using examples, tables or illustrations to provide a full explanation or depiction. All information, statements, figures, content, explanations, examples, and details (collectively, the “Information”) contained above is intended for illustrative and/or information purposes only and should not be relied upon for any purpose whatsoever. Customers should, in the event of any doubt as to how to read or understand the examples, tables, illustration or information, contact OCBC Securities Private Limited for a fuller explanation, depiction or further details.

Enjoy fee waivers and complimentary subscriptions to trading tools & services

New Promotions

Hong Kong Live PricesComplimentary HK live feed the next calendar month when you maintain S$300 or more brokerage in the HK Market the current month. Terms and Conditions apply.

Ongoing fee waivers and complimentary subscriptions

|

Monthly complimentary access to StockReports+ and Market Statistics |

Maintain S$300 brokerage or more every month through online trades |

|

iOCBC Trading Platform Stock Alerts |

Get 30 free daily if you maintain S$900 brokerage or more through online trades every 3 months |

|

Waiver of Foreign Share Custody fees |

Make at least 2 trades every month or 6 trades every 3 months |

|

Waiver of cash dividend handling fees |

Applicable to all Share Financing accounts |

|

US Live Prices |

Complimentary US live feed in the next calendar month when you execute at least 1 successful trade the current month. |

|

Hong Kong Live Prices |

Complimentary HK live feed the next calendar month when you maintain S$300 or more brokerage in the HK Market the current month. |

|

Malaysia Live Prices |

Complimentary Malaysia live feed in the next calendar month when you execute at least 1 successful trade the current month. |

|

Australia Live Prices |

Complimentary Australia live feed the next calendar month when you maintain S$300 or more brokerage in the Australia Market the current month. |

|

UK Live Prices |

Complimentary UK live feed in the next calendar month when you execute at least 1 successful trade the current month. |

Important Notes

These services are only applicable to the iOCBC trading platform for equities. Excludes Futures and Forex platforms and trading.

Online application using Myinfo*

For individual customers who are 21 years and above.

Please prepare a digital copy/picture of your signature to be uploaded (in JPG or PNG, less than 2MB)

Offline and corporate application at a branch or via mail

For individual customers who are 18 to 20 years old, foreigners who do not have Myinfo and corporate customers.