Enjoy share financing rates from as low as 4.00% p.a.

Plus, access lower online commission rates across 5 main markets with the enhanced Quality Priced Loan scheme, QPL+.

Discover exclusive advantages with the Quality Priced Loan scheme, QPL+.

Competitive interest rates based on your securities’ grade

- Grade 1

- Grade 2

- Grade 3

- Grade 4

| Quality of Marginable Securities | Description | SGD Lending Rates | USD Lending Rates | HKD Lending Rates | AUD Lending Rates |

| Grade 1 | Major Global Index Component Securities | 4.00% | 5.70% | 5.25% | 5.25% |

| Grade 2 | Top 100 securities by market capitalisation in respective exchanges that have met certain financial and trading criteria as determined by OCBC Securities | 4.50% | 5.90% | 5.50% | 5.50% |

| Grade 3 | Mid/Small Cap Securities | 5.00% | 6.00% | 5.75% | 5.75% |

| Grade 4 | All other Marginable Securities | 7.00% | 7.00% | 7.00% | 7.50% |

| Quality of Marginable Securities |

| Grade 1 |

| Grade 2 |

| Grade 3 |

| Grade 4 |

Subject to changes without prior notification.

This promotion is valid until 31 December 2026.

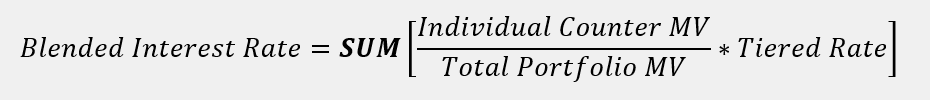

A blended Interest rate is calculated based on the relevant interest rates corresponding to the various grades and will depend on the concentration of Marginable Securities customer holds from each tier.

The marginable value of the customer’s portfolio as of the previous business day, including all outstanding trades, will be used for the computation of the interest rates daily.

The following examples illustrate how interest rates are computed based on the quality and marginable securities in the customer’s portfolio. The blended interest rate in each example is derived from the below formula.

Example 1

|

|

Blended Interest Rate = 4.37% p.a

Example 2

|

|

Blended Interest Rate = 4.00% p.a

Example 3

|

|

Blended Interest Rate = 5.44% p.a.

*MV = Marginable Value

Who is eligible?

For existing Share Financing account holders:

Simply complete the QPL + Selection Form and mail it to us

If you do not have a Share Financing account, open one with us:

Download this Application Form, Memorandum of Charge Form, as well as QPL + Selection Form and mail them to us to open one.

Alternatively, you can visit our branch to open a Share Financing account.

OCBC Securities Investors hub

18 Church Street

#01-00 OCBC Centre South

Singapore 049479

Eligibility requirements

Minimum age

21 and above

Account

Have an existing basic cash trading account with OCBC Securities

Important Notes

Borrowing to finance the trading of securities (leveraging/gearing) carries a high degree of risk. If the value of the collateral declines substantially, falling below the maintenance margin requirement, you may be called upon to deposit substantial additional funds or collaterals on short notice in order to maintain your position. If you fail to comply with a request for additional funds or collaterals within the specified time, your position may be liquidated at a loss and you will be liable for any resulting deficit in your account. Trading in foreign securities includes, but is not limited to, currency risks and rules and regulations peculiar to the respective foreign stock markets.

Customers should note that there are limitations and difficulties in using examples, tables or illustrations to provide a full explanation or depiction. All information, statements, figures, content, explanations, examples, and details (collectively, the “Information”) contained above is intended for illustrative and/or information purposes only and should not be relied upon for any purpose whatsoever. Customers should, in the event of any doubt as to how to read or understand the examples, tables, illustration or information, contact OCBC Securities Private Limited for a fuller explanation, depiction or further details.