Help & Support

iOCBC Disclaimers and Troubleshoot - Troubleshoot

-

Userguide for iOCBC trading platform (desktop)

-

Userguide for iOCBC TradeMobile (app)

-

Accessing iOCBC via secured office environment

The access to iOCBC server may be blocked by your company’s network system (firewall). You may wish to approach your network administrator for assistance. -

How to view the security information under the Buy/Sell ticket on iOCBC

You may view the security information under the Buy/Sell ticket here. Kindly refer to the step-by-step guide below:

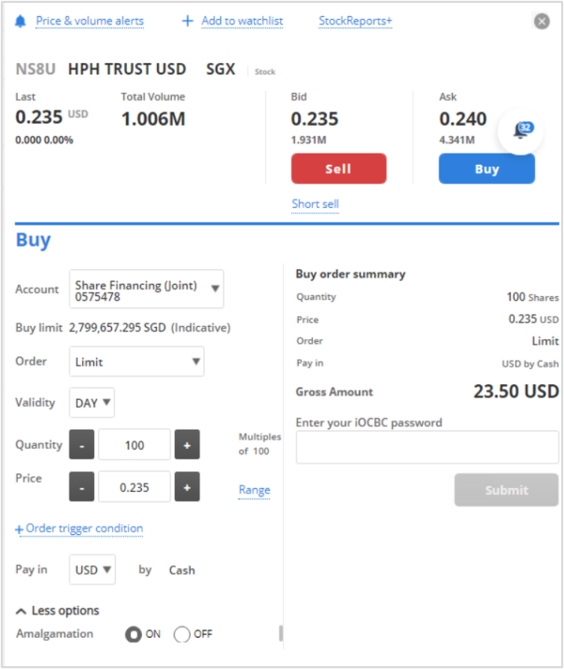

Step 1: Select your desired stock

Step 2 : Check on the Board Lot Size and enter number of units in multiple of board lot size (e.g. 100, 300, 500, 1400, 2200)|

Step 3: Check on the “Traded Currency” and “Price” information (i.e. make cross reference to the Last Done Price/Buy or Sell Price as different securities are traded differently in terms of currencies and bid size)

Step 4: You can opt to settle your trades in the same traded currency or SGD

Step 5: Ensure that you have entered the correct information on the buy/sell ticket before you submit your order to the Exchange

The amalgamation option allows you to combine your orders based on your average traded price. Instead of incurring a minimum brokerage charge for each order, you can save on your brokerage fee by combining all your trades.

The following conditions apply when using amalgamation option:

- You must have indicated “Yes” for amalgamation on all contracts

- The amalgamated trades must be of the same trading day

- The amalgamated trades must be of the same stock

- The amalgamated trades must be of the same settlement currency

- The amalgamated trades must be of the same action (e.g. buy action amalgamates with another buy action)

- The amalgamated trades must be the same payment mode

Entering incorrect price for SGX market

If you entered incorrectly the following prices:

a) Price (buyer) is greater than seller price

b) Price (seller) is lesser than buyer price

If you have entered a higher “buy” price than the “seller” price, your order will be matched accordingly at the seller's price, vice versa.

-

Selecting active trading account number

If you have more than one online trading account, our system will display your lowest numbered trading account number as the default trading account.

Kindly use the “trading account number” drop-down menu on the buy / sell order ticket to trade via your preferred trading account.

Please ensure that you have selected the correct trading account on the buy / sell ticket before proceeding with your order submission.

To change your default trading account on iOCBC:

- Click on the “More” on the top menu

- Select “Account details”

- Use the option “Set my default trading account to” and select your default account.

- Click on the “Submit” button to set the changes.

Please ensure that you have selected the correct trading account on the buy / sell ticket before proceeding with your order submission.

You can double-check the details at the order book again. If you have made a mistake in selecting the wrong trading account number, please withdraw and resubmit your order again immediately.

In the event that the order is fulfilled and cannot be withdrawn, please contact your Trading Representative immediately on Trade Date for further assistance.

-

Check trading limits

(a) Asian markets

To view the available trading limit for Asian markets, you may select any of the stock listed in Asian markets (e.g. SGX) and call-out the buy / sell order ticket accordingly.

(b) Non-Asian markets

To view the available trading limit for non-Asian markets, you may select any of the stock listed in non-Asian markets (e.g. US, UK) and click on the stock name to call-out the buy / sell order ticket.

-

Check board lot size

You may view the board lot size of each stock in the iOCBC order ticket as below:

For more information, please visit the SGX website.

-

How to choose preferred settlement currencies on iOCBC

Click on “More” at the top of the menu and select “Online preferences” . Next, select “Default currencies” to view the list of allowed settlement currencies. In general, all trades are settled in the traded currency.

However, you can choose to set your preferred settlement currencies for your buy and sell trade for each market by clicking the currency code except for those restricted by the exchange controls.

In addition, you can also change the actual settlement currency for each order in buy / sell screen prior to submitting the order through the Internet.

-

Auto-contra

If you have selected cash as the payment mode for your sell orders and at the same time, there is a corresponding outstanding buy contract, iOCBC will auto-contra against your outstanding buy contract regardless of quantity, on a “first-in-first-out” basis. The setoff will be reflected in the settlement currency of the buy contract.

Note:

- Contra / setoff will be applied on trades in foreign securities exchanges. For securities transacted in the Indonesia Stock Exchange, Philippines Stock Exchange and Stock Exchange of Thailand, contra / setoff will only apply to intra-day trades of the same securities (i.e. buy and sell on the same trade date).

- Contra is not allowed for CPF / SRS transactions.

-

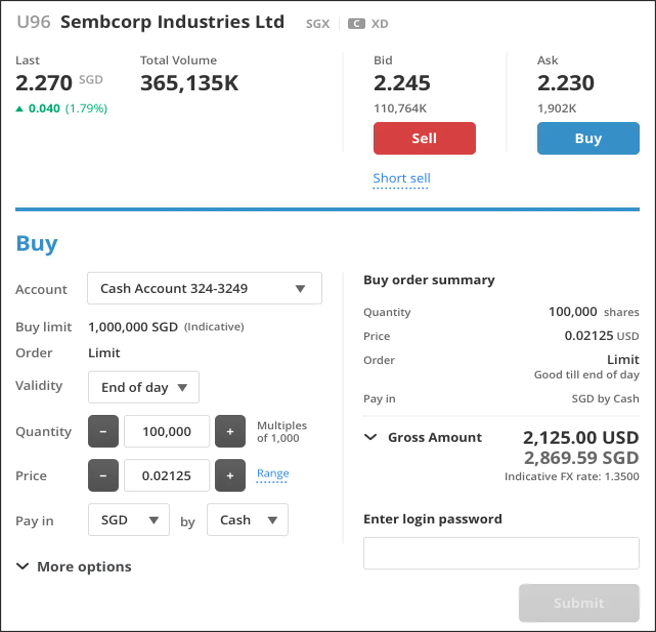

How to view the indicative FX rate on iOCBC

Indicative FX rate can be seen at the order ticket while placing an order when settlement currency is set to SGD. If you have chosen to settle your trades in one of the currencies listed in Board Rates, the rates will be applied in accordance to the timing of the fulfilled trades.

However, in the event where no exchange rate is found in the Board Rates, the exchange rates will be quoted to you only against the fulfilled order in the “Today's Order” after the rates are fixed.

-

Order confirmation alert

You can choose to receive trade confirmation via mobile phone or email. Click on "More" at the top of the menu and select "Alerts". Next, select "Delivery preferences".

Do note that the alerts are provided on an “as is, as available” basis and that no warranty is provided as to the availability or timeliness of such alerts. You are requested to check the status of your orders via iOCBC each time you submit your orders.

In addition, we will send daily e-statement contract notes.

-

Check order status

You can check the status of the order by clicking on “Orders” on the top menu and select “Current Orders”. To check your previous days’ orders, select “Past Orders”.

Your submitted orders will be shown along with any of the following status:

Status Description Status Description Q Order accepted in queue PA Reduced order pending to be processed by the Exchange PO Pending to enter queue AC Reduced order accepted F Filled order PC Cancelled order for unfilled quantity pending to be processed by Exchange PF Partially-filled quantity C Cancelled order for unfilled quantity accepted R Order rejected and void U Unknown status E Expired order PE Partially expired order with partial-filled quantity S Suspended / rejected - unfilled quantity is void Amend / withdraw orders

You can amend / withdraw your order provided that the order is not filled. If the order is partially filled, you can only make amendment / withdrawal on those unfilled quantity.

For non-SGX orders, amendment is only for reduction of the quantity and you cannot amend the other parameters like price and payment mode.

For SGX orders, with the introduction of SGX Reach Advanced Orders, you can now amend your SGX order by increasing or decreasing the price and/or quantity. This may result in a possible change in the priority of your order:SGX Order Amendment Action

Order Priority

Decrease in Order Quantity

Priority of the order will be maintained

Increase in Order Quantity

Priority of the order will be lost

Increase/Decrease in Order Price

Priority of the order will be lost

Your modified order price will subject to a bid range validation check by the SGX.

These features are made available to all clients.

To check the latest status of your order, please click on the “Refresh” button.

If your amendment request is successful, your order status will be updated to “AC” (i.e. reduced order accepted)

If your withdrawal request is successful, your order status will be updated to "C” (i.e. cancelled order accepted).

You are required to check under “Qty” & “Qty Done” column to ensure that you have executed the correct quantity.

Unfulfilled orders

Orders that are not fulfilled will expire automatically at end of the day. If you wish to place the same trade order for the next market day, you are required to resubmit accordingly.iOCBC current portfolio

It is not advisable to sell shares based on the quantity reflected in your iOCBC current portfolio as the iOCBC current portfolio only captures transactions via OCBC Securities Pte Ltd and is only an indicative representation of your portfolio.

Please note that the following actions will not be updated on the iOCBC Current Portfolio:

- Allotment of Initial Public Offering (IPO) shares;

- Shares purchased / sold via other securities firms

- Shares transferred inwards or outwards

- Any corporate actions such as Shares Consolidation, Shares Split, Rights Issue and Bonus Issue

- Full or partial CPF revoked trades

Verify your actual holdings against your CDP / CPF Investment / SRS / Share Financing / Custodian statements. Any positions which are oversold will be constituted as “short selling” and will be subject to buying-in by SGX.

To avoid selling the wrong quantity due to corporate actions, we strongly encourage you to read the company announcements at SGX, Bursa Malaysia or other exchanges’ websites before you submit your order online.Types of advanced orders and how to submit on iOCBC

1. What are the Advanced Order types and order validities available on iOCBC?

Advanced Order types available on iOCBC and iOCBC TradeMobile include:- Limit Orders

- Market Orders

- Market-to-Limit Orders

- Session State Orders

- Price Triggered Orders

- Stop Orders

- If-Touched Orders

iOCBC offers the following order validities:

- Day Order

A day order is valid only on the day the order is sent to exchange. If it is not matched, it will be removed from the exchange at the end of the trading day. - Good-Till-Date (GTD)

A Good-Till-Date order will come with a date the order will expire, which could be up to a maximum of 30 days from the day the order is placed. It stays in the exchange until it is fully filled, specifically cancelled, or the instrument is de-listed or expired. - Fill or Kill (FOK)

The order is matched in entire quantity or completely cancelled. There is no partial fill. The order is not stored in the exchange. - Fill and Kill (FAK)

The order is matched with as much quantity as possible and the unmatched quantity is cancelled. The order is not stored in the exchange.

2. How do I apply for access to the various Advanced Order Types?

Advance Order types for SGX Market are granted to all clients by default.

Currently, only clients with cash account are allowed to place all types of advanced orders.

For more details, please visit https://www.sgx.com/securities/trading.

3. On which markets may I place Advanced Orders?Advanced Orders are currently available on the SGX only.

4. Amend order

With the introduction of SGX Advanced Orders, you can now amend your SGX order by increasing or decreasing the price and/or quantity. This may result in a possible change in the priority of your order.SGX Order Amendment Action Order Priority Decrease in Order Quantity Priority of the order will be maintained Increase in Order Quantity Priority of the order will be lost Increase/Decrease in Order Price Priority of the order will be lost

Your modified order price will subject to a bid range validation check by the SGX.

These features are made available to all clients.

5. What are the types of Advanced Orders I can submit at different trading phases?

Order Types / Validities Pre-Open Open Pre-Close Limit Orders Fill-and-Kill (FAK) √ √ √ Fill-or-Kill (FOK) × √ × Day √ √ √ Good-Till-Date (GTD) √ √ √ Trigger Criteria Stop Orders × √ × If-Touched Orders × √ ×

6. How do I access the new order types with various validities, and how do I submit the orders?

On the iOCBC order ticket, click on “Validity” to select the validities from the dropdown list. Before placing an order, you will need to read and accept the one-time disclaimers.

Good-Till Date (GTD) Order on iOCBC

A GTD order allows you to place an order that remains in the queue in SGX up to a specified date, until it is fully filled, specifically cancelled, or when the stock is delisted or expired. GTD orders can be specified up to a maximum of 30 calendar days from the day the GTD order is placed.

For more information on trading GTD orders through iOCBC, click here.

Limit orders

1. What is a Limit Order?

Limit orders allows a buy or sell of a stock at a specified price or better.

2. How does a Limit Order works with the different validities?

- Day limit order

Any portion of the order that can immediately be matched is traded as soon as the order is entered. The rest of the unfilled order sits in the market until it is matched or it will be removed from the exchange at the end of the trading day. - Good-Till-Date (GTD) limit order

Any portion of the order that can immediately be matched is traded as soon as the order is entered. The rest of the unfilled order sits in the market until it is fully filled, specifically cancelled, or the instrument is de-listed or expired.

Good-Till-Date’s order will come with a date the order will expire, which could be up to a maximum of 30 days from the day the order is placed.

Example: If the day the order is placed is 1 April 2017 and the you want to keep the order in the market for 3 days, the order can rest in the market till the end of trading day on 3 April 2017 or be filled before that. - Fill-or-kill (FOK) limit order

The whole order quantity which is entered into the market must be matched in full or the order will be cancelled. The order is not stored in the exchange.

Example: A limit order to buy 20 lots of ABC shares at $1 will only be matched if there are at least 20 lots of ABC shares with best available ask of up to $1. If there are fewer than 20 lots available, the entire buy order will be cancelled with no part being matched. - Fill-and-kill (FAK) limit order

Any portion of the order that can immediately be matched is traded as soon as the order is entered into the market. The rest of the unfilled order will be cancelled. The order is not stored in the exchange.

Example: A limit order to buy 20 lots of ABC shares at $1 will have a partial match of 8 lots if there are only 8 lots of ABC shares with best available ask of up to $1 in the order book. The buy order for the remaining unmatched 12 lots will be cancelled.

Price Triggered Orders

1. What is a Price Triggered Order (PTO)?

It is an instruction to buy or sell an instrument when the trigger price condition is reached. Once the price meets the condition that was set up, the PTO will be converted to an active tradable order. It is not visible to the market before it is converted to the specific order.

There is no long dated PTO as any PTO not activated by the end of the trading day will be automatically deleted from the system.PTOs can only be entered, modified, cancelled and triggered during the Open trading phase. PTOs can be entered with any order type and validity for the to-be-triggered order. However, validation of the allowable order type and validity for the to-be-triggered order will only be done upon activation of the order.

The current types of PTOs available are Stop Orders and If-Touched Orders.

Stop Orders

1. What is a Stop Order?

The order will be converted into an actual order, once condition (stop price) is met. This order helps an investor to minimise their loss.

2. How does a Stop Limit Order work?

Sell Stop Limit (for long position)

An investor has a long position of 100 shares of ABC stock bought at $5, and he wants to limit his loss to $100. The current last done price of ABC stock is $4.40. He would place a stop limit order to sell with a stop price at $4.20 and the limit price at $4.00.

In this case, the stop price is placed below last done price and the limit price is placed below the stop price, i.e.Last Done Price > Stop Price > Limit Price

As long as the order can be filled at or above the limit price, it will be executed.

Buy Stop Limit (for short position)

An investor has a short position of 100 shares of ABC stock sold at $5, and he wants to limit his loss to $100. The current last done price of ABC stock is $5.40. He would place a stop limit order to buy back the shares with a stop price at $5.60 and the limit order price at $6.00.

In this case, the stop price is placed above the last done price and the limit price is placed above the stop price, i.e.Limit Price > Stop Price > Last Done Price

3. What are the risks associated with a Stop Order?

- Stop price can be triggered by a short term fluctuation in a stock’s price.

- For stop market orders, once the stop price is reached, the stop order will be converted into a market order. The transacted price can be different from the stop price since stock prices can change rapidly.

- If an investor wants to avoid the risk of a stop market order, the investor can choose to place a stop limit order. However, there will be no guarantee that the order will be filled in the event the price gaps through the limit price.

If-Touched Orders

1. What is an If-Touched Order?

The order will be converted into an actual order, once the condition (trigger price) is met. This helps an investor to maximise the profit gain without having to constantly monitor the market movement. It can also be used to create new positions in anticipation of a particular reversing trend.

2. What is the difference between a Stop Order and a If-Touched Order?

The difference between a stop order and an If-Touched order is that a stop order is typically used as a loss-limiting mechanism in respect of open positions, while an If-Touched order is used to create new positions in anticipation of a particular reversing trend. In a falling market, an investor may want to enter the market at a favourable price should the market rebound. Similarly, in a rising market, an investor may want to enter into a short position should the price begin to fall.

3. How does a Limit-If-Touched work?

ABC shares are currently trading at $2.60. An investor wants to open a long position to buy 10 lots of ABC shares only when ABC shares falls back to $2.50. However, he also wants to buy at a better price than $2.50, for instance $2.40. In this case, the investor can enter a limit-If-Touched buy order with an order trigger price of $2.50 and a limit price of $2.40.

During the day, if the price of ABC shares starts falling from $2.60 and reaches $2.50, the limit-If-Touched buy order is converted into a limit buy order for 10 lots of ABC shares at $2.40. The buy limit order will only be executed at $2.40 or better price. If the market price never goes down to $2.40 or better, the order will not be executed.

4. What are the risks associated with an If-Touched Order?

- Trigger price can be triggered by a short term fluctuation in a stock’s price

- For If-Touched market orders, once the trigger price is reached, the order will be converted into a market order. The transacted price can be different from the intended price since stock prices can change rapidly

- If an investor wants to avoid the risk of an If-Touched market order, the investor can choose to place an If-Touched limit order. But the remaining unfilled limit order may not get processed if the price goes beyond the limit price. There is no guarantee that the order will be filled in the event the price gaps through the limit price.

Force order

Under normal circumstances, your order will be rejected by the SGX trading system if the order price is more than 30 bids away from the last done price. “Force order” is a function that enables you to ‘force’ your order through and put your order on the queue.

Although force order allows you to submit order not within the normal price range, you are baring the risk of keying in undesirable price by mistake. Force key is granted to client at the sole discretion of your Trading Representative. We advise you to exercise caution when you submit order with force key.

Kindly refer to SGX website for more information on Minimum Bid Sizes.

Note:

Force order is not allowed for foreign markets. Force order should not be used when the trade not likely to be matched.Limit recycling

Limit Recycling will be applicable to your iOCBC Cash Trading Account under 2 scenarios: (1) your online buy trade has a matching sell trade of the same shares (2) your online sell trade has a matching buy trade of the same shares, under the same trading account number.

Trades available for Limit RecyclingDescription Eligible for limit recycling Ineligible for limit recycling Types of trading account Cash Trading Account Share Financing Account

Share Borrowing AccountPayment Mode Cash only CPF, SRS Markets with Inter-day Recycling SGX - Markets with Intra-day Recycling ASX, SSE (Shanghai), HKEX, IDX, TSE, Bursa, SGX, LSE, AMEX, NASDAQ, NYSE SZSE (Shenzhen), PSE, SGX (Unit Shares/Odd Lot), SET Type of orders Online sell trades with matching buy trades or online buy trades with matching sell trades.

For Singapore Market: Outstanding buy contracts including all unsettled buy contracts and overdue contracts.- Broker-assisted sell orders

- Force selling conducted by OSPL

Illustration 1: Intra-day matching buy and sell with contra gain

Buy 1,000 ABC shares at S$1.00

Sell 1,000 ABC shares at S$1.50 (contra gain of S$500*)

Existing limit calculation New limit calculation Action Approved limit (1) Limit utilised (2) Available limit (3) = (1) - (2) Recycled limit (4) Available limit (5) = (3) + (4) Buy S$5,000 S$1,000 S$4,000 S$1,000* S$5,000 Sell S$10,000 S$1,500 S$8,500 S$1,500 S$10,000 *Note: The contra gain of S$500 will not be reinstated to the customer’s buy limit.

Illustration 2: Intra-day matching buy and sell with contra loss

Buy 1,000 ABC shares at S$1.00

Sell 1,000 ABC shares at S$0.40 (contra loss of S$600)

Existing limit calculation New limit calcuation Action Approved limit

(1)Limit utilised

(2)Available limit

(3) = (1) – (2)Recycled limit

(4)Available limit

(5) = (3) + (4)Buy S$5,000 S$1,000 S$4,000 S$400^ S$4,400^ Sell S$10,000 S$400 S$9,600 S$400 S$10,000 ^Notes: When customer sells 1,000 ABC shares at S$0.40, he incurs a contra loss of S$600. Henceforth, only S$400 is being recycled at the buy side in his iOCBC cash trading account. He will not be able to get back his full buy limit of S$1,000.

Illustration 3: Inter and Intra-day multiple buy orders and sell with contra loss (Only applicable for Singapore market)

Approved buy limit: S$10,000a

Approved sell limit: S$20,000bExisting limit calculation New limit calculation Action Approved limit (1) Limit utilised (2) Available limit (3) Recycled limit Available limit Day 1 Buy 5,000 at S$0.30 S$10,000 S$1,500 S$8,500

On Day 2: S$2,100 (Recycled to the Buy & Sell Limits based on Selling Price S$0.30 for 7,000 shares.)On Day 2:

Buy Limit will be S$7,100 (=S$5,000 + S$2,100)

Sell Limit will be S$20,000 (S$17,900 + S$2,100)Day 2 Buy 5,000 at S$0.70 S$10,000 S$3,500 S$5,000 (S$8,500 - S$3,500) Day 2 Sell 7,000 at S$0.30 S$20,000 S$2,100 S$17,900 Notes:

aBuy Limit

When customer sells 7,000 shares at S$0.30, he incurs a contra loss of S$1,400 (i.e. based on an average buy price of S$0.50). The contra loss of S$1,400 will be marked down against the recycled buy limit during intra-day. Henceforth, only S$2,100 is recycled to the buy limit based on the selling price of S$0.30 for 7,000 shares.

Available buy limit will only be S$7,100 (i.e. S$5,000+ S$2,100).

bSell Limit

Recycled sell limit will be S$2,100 based on the selling price of S$0.30 for 7,000 shares.

Available sell limit will be reinstated to S$20,000.

Illustration 4: Intra-day matching sell and buyBuy 1,000 ABC shares at S$1.80

Buy 1,000 ABC shares at S$1.00 (contra gain of S$800#)

Existing limit calculation New limit calcuation Action Approved limit

(1)Limit utilised

(2)Available limit

(3) = (1) – (2)Recycled limit

(4)Available limit

(5) = (3) + (4)Sell S$10,000 S$1,800 S$8,200 S$1,800 S$10,000 Buy S$5,000 S$1,000 S$4,000 S$1,000# S$5,000 #Note: The contra gain of S$800 will not be reinstated to the customer’s sell limit.

Illustration 5: Intra-day matching sell and buySell 1,000 ABC shares at S$1.00

Buy 1,000 ABC shares at S$1.80 (contra loss of S$800**)

Existing limit calculation New limit calcuation Action Approved limit

(1)Limit utilised

(2)Available limit

(3) = (1) – (2)Recycled limit

(4)Available limit

(5) = (3) + (4)Sell S$10,000 S$1,000 S$9,000 S$1,000 S$10,000 Buy S$5,000 S$1,800 S$3,200 S$1,000** S$4,200** **Notes: When customer buys 1,000 ABC shares at S$1.80, he incurs a contra loss of S$800. Henceforth, only S$1,000 is being recycled at the buy side in his iOCBC cash trading account. He will not be able to get back his full buy limit of S$1,800.