-

15 Dec 2025

Changes to Operating Hours on 24 December and 31 December 2025

Please be advised that the OCBC Securities Investors Hub and our customer service hotline will have reduced operating hours on 24 December and 31 December 2025, from 8:30 am to 12:30 pm.

We will be closed on 25 December 2025 and 1 January 2026, in observance of public holidays.

For frequently asked questions, please visit the OCBC Securities website (Support section).

Alternatively, you may contact us via email askocbcsec@ocbc.com.

We wish you a Merry Christmas and a Happy New Year. -

12 Dec 2025

Scheduled maintenance for iOCBC website on Saturday, 13 December 2025

The iOCBC Online Trading Portal and Mobile Trading Platform will be unavailable during the period shown below due to scheduled system maintenance.

Saturday, 13 December 2025, 09:00am to 06:00pm

We apologise for any inconvenience caused. -

12 Dec 2025

Introduction of Non-cancellation Period for Indonesia Stock Exchange (“IDX”) Effective 15 December 2025

Please be informed that with effect from 15 December 2025, IDX will be introducing a Non-cancellation Period during the Pre-opening and Pre-closing sessions.

New trading hours (SGT) will be as follows:

Monday-Thursday

Pre-Opening: 9.45am-9.59.59am

Non-Cancellation Period*: 9.56am-9.59.59am

Session 1: 10.00am-12.59.59pm

Break: 1.00pm-2.29.59pm

Session 2: 2.30pm-4.49.59pm

Pre-Closing: 4.50pm-5.01.59pm

Non-Cancellation Period^: 4.56pm-5.01.59pm

Post-Closing#: 5.02pm-5.15pm

Friday

Pre-Opening: 9.45am-9.59.59am

Non-Cancellation Period*: 9.56am-9.59.59am

Session 1: 10.00am-12.29.59pm

Break: 12.30pm-2.59.59pm

Session 2: 3.00pm-4.49.59pm

Pre-Closing: 4.50pm-5.01.59pm

Non-Cancellation Period^: 4.56pm-5.01.59pm

Post-Closing#: 5.02pm-5.15pm

*Order matching will take place from 9.58am to 9.59.59am. No order withdrawal between 9.56am and 9.57.59am and no order amendment between 9.56am and 9.59.59am for orders that are not matched.

^Random closing will take place from 4.58pm to 4.59.59pm and order matching will take place from 5.00pm to 5.01.59pm. No order withdrawal between 4.56pm and 4.59.59pm and no order amendment between 4.56pm and 5.01.59pm for orders that are not matched.

#Trade allowed only on closing price. -

08 Dec 2025

Unilever Corporate Action on 8th and 9th December 2025

Unilever PLC will separate its ice cream business via a demerger of The Magnum Ice Cream Company on Monday 8 December 2025, followed by a consolidation of Unilever’s share capital on Tuesday 9 December 2025.

Shareholders are advised to exercise caution when trading these shares and take note of any further announcements made by Unilever PLC.

For more information, shareholders can visit https://www.unilever.com/investors/

(You will be redirected to an external website. Please note that OCBC Securities does not endorse or take responsibility for the content, accuracy, or security of such external websites.) -

17 Nov 2025

Latest TradeMobile App Version

Please update your iOCBC Mobile Trading Platform to the latest version now. The previous App version will be discontinued.

Mobile devices

Latest App version

iOS

6.3

Android

1.69

Users of iOCBC Mobile Trading Platform with old versions will no longer be able to access iOCBC Mobile Trading Platform after such versions of the app have been disabled. -

03 Oct 2025

Implementation of Sales & Service Tax for Clearing Fee on Bursa Malaysia Effective 1 Oct 2025

Please be informed that effective 1 Oct 2025, Bursa Malaysia will be imposing a Sales and Service Tax (SST) of 8% on the clearing fee for the trading of securities of selected instruments listed on Bursa Malaysia. This is in accordance with the latest policies and guidelines issued by the Royal Malaysian Customs Department.

The clearing fees for both buy and sell transactions of securities that fall under the instrument categories below will be subjected to 8% SST:

• Warrants

• ETF

• Structured Warrants

• Ordinary Rights/Loan Rights

• REITS/Stapled Securities

• Trust

You may refer to our Commission Rates and Charges for the updated fees and charges.

If you have any questions or need help, do reach out to your Trading Representative. -

31 Jul 2025

Revision of Minimum Spread and Quotation Rules on Hong Kong Exchange Effective 4 August 2025

Please be informed that effective 4 August 2025, Hong Kong Stock Exchange (HKEX) will be revising the minimum spread and quotation rules for Hong Kong securities.

Reduction of Minimum Spread

There will be a reduction in minimum spread applicable to all securities except the following:

• Exchange Traded Products (ETPs)

• Debt Securities

• Exchange Traded Options (ETOs)

• Inline Warrants

• Structured Products

Updated Minimum Spread Table (Stocks)

Price band Current Minimum Spread

New Minimum Spread (effective 4 Aug 2025)

$0.01 to $0.25

$0.001

$0.001

> $0.25 to $0.50

$0.005

$0.005

> $0.50 to $10.00

$0.010

$0.010

> $10.00 to $20.00

$0.020

$0.010

> $20.00 to $50.00

$0.050

$0.020

> $50.00 to $100.00

$0.050

$0.050

> $100.00 to $200.00

$0.100

$0.100

> $200.00 to $500.00

$0.200

$0.200

> $500.00 to $1,000.00

$0.500

$0.500

> $1,000.00 to $2,000.00

$1.000

$1.000

> $2,000.00 to $5,000.00

$2.000

$2.000

> $5,000.00 to $9,995.00

$5.000

$5.000

Revision of Quotation Rules

The allowable price limit under the Quotation Rules for all securities except ETPs will be revised from +/- 24 spreads to either +/- 24 spreads or 5% from the reference price, whichever is greater in percentage terms. This will apply across all price bands during the Continuous Trading Session.

Kindly refer to the Hong Kong Market Information page for more details.

If you have further questions or need help, do reach out to your Trading Representative. -

15 Jul 2025

Latest TradeMobile App Version

Please update your iOCBC Mobile Trading Platform to the latest version now. The previous App version will be discontinued.

Mobile devices

Latest App version

iOS

6.0

Android

1.67

Users of iOCBC Mobile Trading Platform with old versions will no longer be able to access iOCBC Mobile Trading Platform after such versions of the app have been disabled. -

30 Jun 2025

Revision in Philippine Stock Transaction Tax (STT) Effective on 1 July 2025

Please be informed that effective 1 July 2025, the STT applicable on the sale of Philippine securities will be reduced from 0.60% to 0.1%.

The revised tax rate will apply to the sale of securities listed on Philippine Stock Exchange (PSE) and Emperador Inc listed on Singapore Exchange (SGX) executed on or after 1 July 2025.

You may refer to our Commission Rates and Charges for the updated fees and charges.

If you have further questions or need help, do reach out to your Trading Representative. -

23 Jun 2025

Enhancement of Settlement Arrangement for Multi-counter Eligible Securities listed on Hong Kong Exchange Effective 30 Jun 2025

Please be informed that effective 30 June 2025, Hong Kong Stock Exchange (HKEX) will be enhancing the settlement arrangement for Multi-counter Eligible Securities by adopting a single tranche multiple counter arrangement.

The enhancement seeks to improve the scalability of trading Multi-Counter Eligible Securities, including Dual Counter Securities and multi-counter Exchange Traded Products through fully fungible securities.

On iOCBC platforms (iOCBC), the Multi-counter Eligible Securities will continue to be displayed as different counters for trading as per existing trading arrangement. Domain settlement counter* will be used for subsequent post-trade processing and portfolio valuation.

Kindly refer to the Hong Kong Market Information page. for more details.

If you have any questions or need help, do reach out to your Trading Representative.

*The stock code of the trading counter in HKD will be used as the domain settlement counter code, unless as per designated by Hong Kong Securities Clearing Company Limited (HKSCC) from time to time. -

19 Jun 2025

Introduction of Post-Close Trading for Australian Securities Exchange (“ASX”) effective 23 June 2025

Please be informed that with effect from 23 June 2025, ASX will be introducing a new Post Close trading session after the Closing Single Price Auction (“CSPA”).

New trading hours will follow as below (SGT):

Non-Daylight Saving Normal Trading Hours

8am – 2pm

Pre-CSPA

2pm-2.10pm

CSPA

2.10pm – 2.11pm

Post-Close*

2.11pm-2.21.30pm

Daylight Saving Normal Trading Hours

7am – 1pm

Pre-CSPA

1pm-1.10pm

CSPA

1.10pm – 1.11pm

Post-Close*

1.11pm-1.21.30pm

*Orders submitted will only be matched at CSPA price.

Kindly refer to the ASX Market information page for more details. -

17 Jun 2025

Be wary of phishing links that lead you to fake OCBC websites

BE WARY of SMSes claiming issues with your accounts or social media postings offering free gifts purportedly from the bank.

DO NOT click on any links in these SMSes which are phishing links that lead you to fake OCBC websites.

Never divulge your banking credentials or one-time passwords to anyone, or key such confidential information into unverified webpages. Find out more on how you can spot a scam with our Security Advisory.

If in doubt, call the OCBC Securities' official hotline at 1800 338 8688 (or +65 6338 8688 if you are overseas). -

17 Jun 2025

Scammers will impersonate anyone

In 2021, the largest amount lost in a single impersonation scam was $6.2 million. Do not be the next victim.

Here are some tell-tale signs that scammers are on the prowl:

Received a phone call from an unknown number with the “+” prefix, supposedly from a government agency or the police, claiming that you are under investigation for a crime?

Got an SMS asking you to call a hotline or click on a URL to resolve an issue involving your trading account?

Take a step back and think before you act. Read on and protect yourself.

Impersonation scams prey on your fears

Impersonation scams evolve. Scammers today claim to be the police, bank staff and local or overseas government officials. Here is how they may prey on you:

What they will steal: Trading account login credentials

Where: Through phone calls usually with the “+” prefix, social messaging apps, automated voice messages and SMSes

How: Scammers typically play on your fears, giving you a variety of reasons and asking you to act quickly.

Here are 2 common methods:

1. In the first method, you may receive phone calls, usually with the “+” prefix, from scammers who claim to be government officials. The scammers will tell you that you are under investigation for crimes.

2. In the second method, you may receive an SMS claiming that your trading accounts have been suspended and you must either click on a URL link or call a number stated in the SMS.

Under the pretext of resolving the issue, the scammers may ask you to take one or more of the following actions:

• Provide your trading account login credentials and/or One-Time Passwords (OTPs) – this will allow them to make fraudulent and unauthorised transactions.

• Reveal your login credentials to some foreign ‘police’ or ‘government official’ who is investigating offences in Singapore or overseas.

• Scan a Singpass QR code on a phishing site (on the pretext that it is part of a verification process).

How to protect yourself

• Do not call any numbers or click on any links in SMSes. We will never send an SMS to inform you about login issues, account closures or your being locked out of your account.

• Do not key such information into unverified webpages. We will never send you any SMSes or emails with clickable URLs.

• Be wary of calls with the “+” prefix, especially when you are not expecting an international call. Always verify the identity of the person(s) and the organisation(s) by calling their hotline numbers.

• Do not provide your Username, Password and/or OTP to anyone. OCBC Securities’ employees will never ask you to reveal your Password/OTP or transfer funds to personal accounts.

• Always read your trade notifications carefully and notify us immediately if the transactions are not performed by you.

• Never authorise a transaction or login unless you know its purpose.

If you believe you have fallen prey to such scams, please call our OCBC Securities’ hotline immediately at 1800 338 8688 (or +65 6338 8688 if you are overseas) – press option 9 to report fraud. -

17 Jun 2025

Protect yourself against malware

Look out – especially if you have an Android device.

New variants of Android malware (‘malicious software’) allow scammers to control your device remotely or steal sensitive information like login credentials or card details. This means that scammers can log in to your account and make fraudulent transactions or transfers without your knowledge.

Android malware may be found in apps available in the Google Play Store. They could also be disguised as ‘helpful apps’ in Android Package Kit (APK) files that you may be tricked into downloading. By downloading them or giving access to certain functions, you may unwittingly allow scammers to take control of your device.

The Police and the Cyber Security Agency of Singapore have released an advisory on malware. Read more.

Here is how you can protect yourself against malware:

• Only download apps from the App Store (for iOS) or Google Play Store (for Android).

• Do not download apps (e.g. email attachments, pop-up advertisements or links coming from unsolicited emails, messages or social media posts) without verifying the authenticity and source.

• When installing apps, review the permissions that are requested. Make sure they are genuinely necessary. Asked to download additional apps? Be very wary.

• Install anti-virus software and malware removal tools on phones, computers and devices with Internet access.

• Always get the latest versions of your devices’ operating systems and applications – the latest security patches will address security vulnerabilities. Enable automatic updates so your devices are protected.

• Check transaction details carefully and read the notifications we send you. Notify us immediately if you receive alerts for transactions you did not make.

If you believe you have fallen prey to such scams, please call our OCBC Securities’ hotline immediately at 1800 338 8688 (or +65 6338 8688 if you are overseas) – press option 9 to report fraud.

As scams constantly evolve, please stay vigilant at all times.

This message contains links to third-party websites. By accessing any such websites, you agree to our terms of use. -

17 Jun 2025

Caution

Stay alert for SMSes from scammers posing as OCBC Securities. Our SMSes are always sent from 'OCBCSec' or 'OCBC Bank' and never include links. -

17 Jun 2025

Alert on "pump and dump" scams

There are scammers on social media platforms such as WeChat perpetuating “pump and dump” scams involving overseas listed companies. Be wary of stock tips provided by persons you have befriended online.

Visit www.police.gov.sg to find out more. -

17 Jun 2025

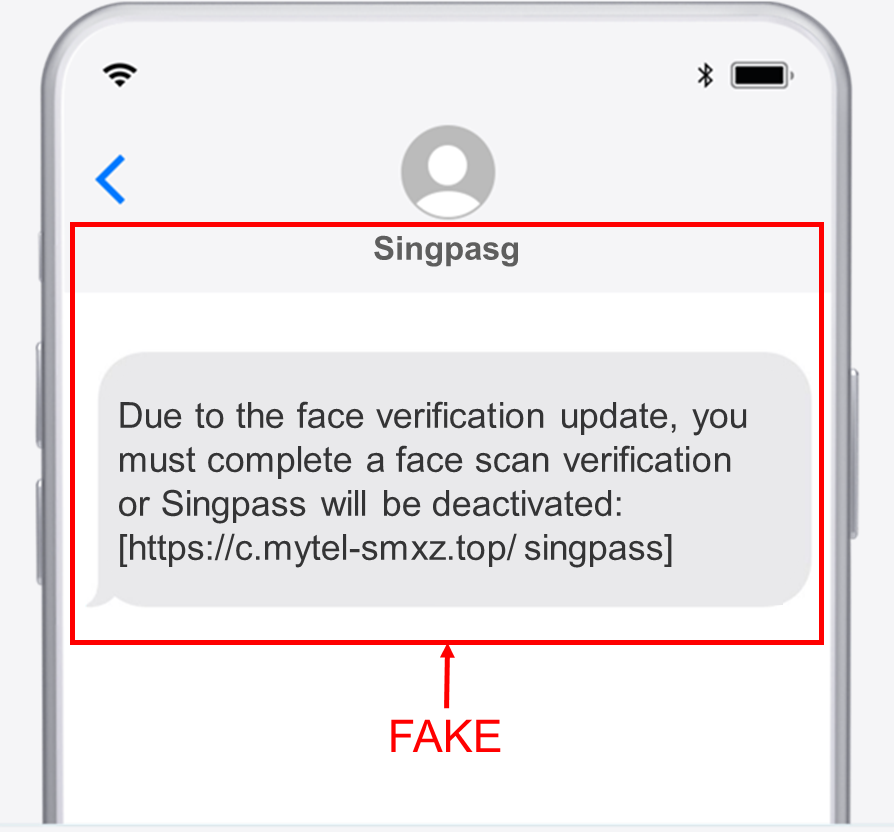

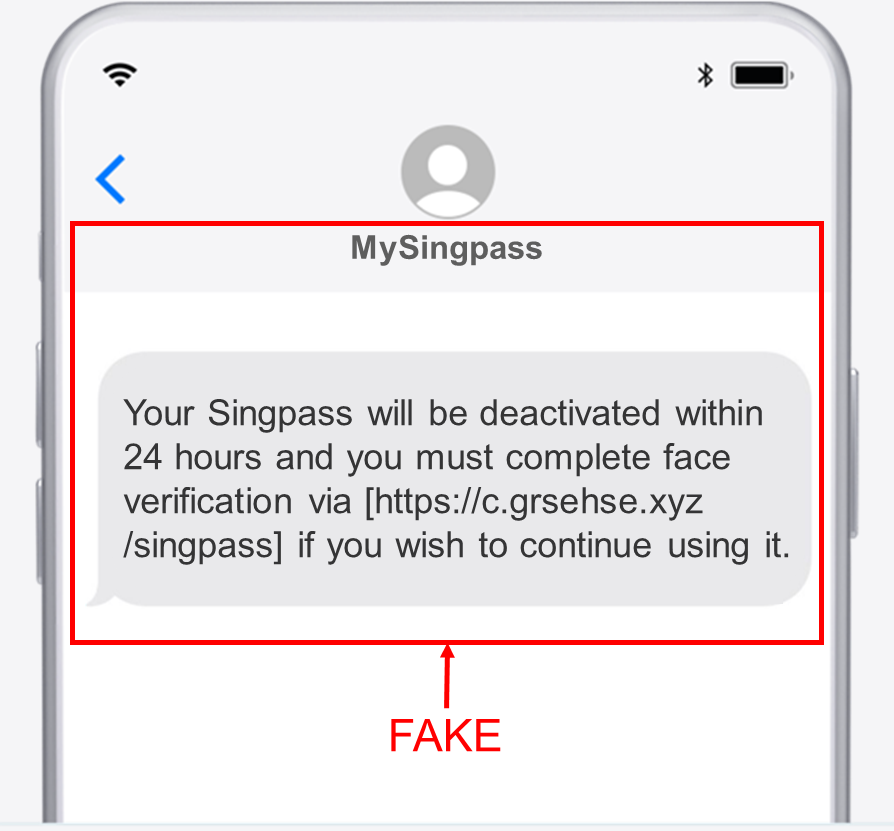

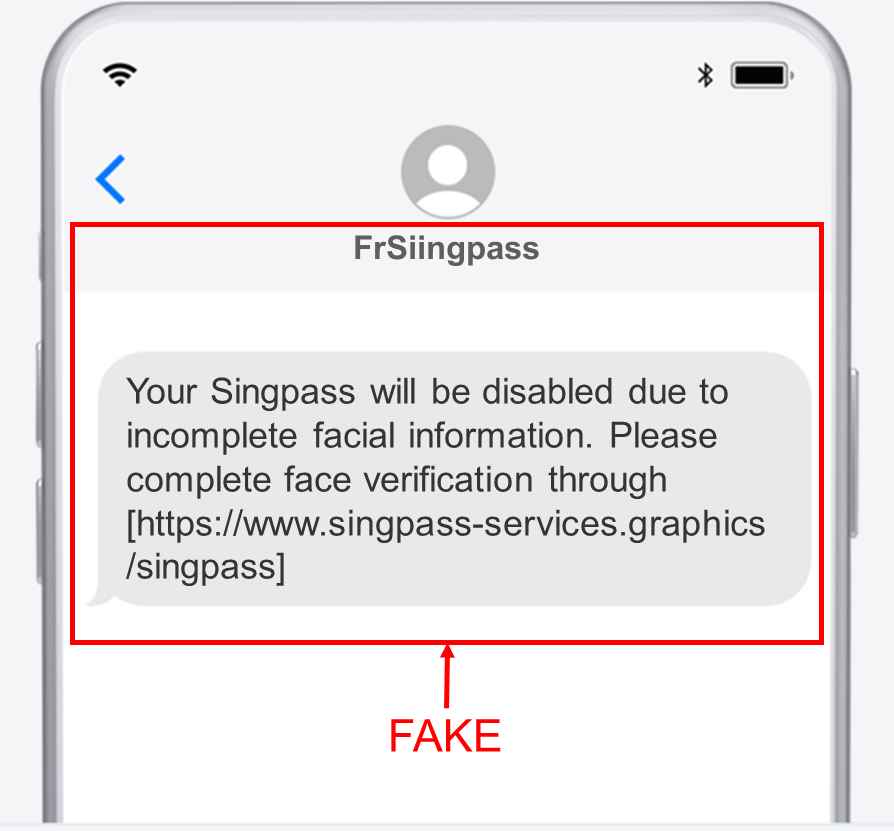

Protect your Singpass login credentials

Scammers are now sending phishing SMSes to obtain your Singpass login credentials.

If you click on the links in such SMSes, you will be taken to a spoofed Singpass login page and asked to key in your Singpass ID and password.

Thereafter, you may be directed to a spoofed login page and prompted to enter your credentials and One-Time Password (OTP). The scammers will then use these to fraudulently apply for credit cards or open banking or trading accounts.

Please take heed when asked for your Singpass login credentials. Do not let your guard down.

These are what such phishing SMSes look like:

Read the police advisory on phishing scams that target your Singpass login credentials here.

To protect yourself, keep these tips in mind:

- Singpass is your digital identity. Treat it with care as your Singpass login credentials can be used to access thousands of services, including applying for credit cards or opening banking and trading accounts.

- Do only scan the Singpass QR code on the website of the digital service that you wish to access or tap the Singpass QR code on the app of the digital service.

- DO NOT key any personal information into unverified webpages.

- If you believe you have fallen prey to a scam, please call our OCBC Securities’ hotline at 1800 338 8688 (or +65 6338 8688 if you are overseas) – press option 9 to report fraud.

Opening an OCBC Securities account by scanning a Singpass QR code?

- Always check and ensure that the OCBC Securities URL shown in your Singpass app matches the URL on your browser.

OCBC Securities URL: www.iocbc.com - Ensure that the login or transaction request was initiated by you before proceeding on the Singpass app.

As scams constantly evolve, we must keep ourselves updated on the latest trends and be alert to the signs to look out for. Visit ScamAlert.sg to learn how to avoid falling prey to scams.

This message contains links to third-party websites. By accessing any such websites, you agree to our terms of use. -

12 Jun 2025

Revision in Stock Settlement Fee on the Hong Kong Stock Exchange Effective 30 June 2025

From 30 June 2025, the Hong Kong Stock Exchange (“HKEX”) will remove the minimum and maximum components of the stock settlement fee (“CCASS fee”). The CCASS fee will also be revised to 0.0042% across all trade sizes.

Please view our revised commission rates and charges.

If you have further questions or need help, do reach out to your Trading Representative. -

11 Jun 2025

Scheduled maintenance for iOCBC website on Saturday, 14 June 2025

The iOCBC Internet Trading Portal and Mobile Trading Platform will be unavailable during the period shown below due to scheduled system maintenance.

Saturday, 14 June 2025, 09:00am - 06:15pm

We apologise for any inconvenience caused. -

06 Jun 2025

Revision in Indonesia Stock Exchange (“IDX”) Trading Hours on iOCBC Trading Platforms (“iOCBC”) Effective 16 June 2025

Please be informed that with effect from 16 June 2025, iOCBC will be supporting IDX pre-opening session. New trading hours will follow as below (SGT):

Mon – Thurs Pre-Opening*

9.45am-9.59.59am

Session 1

10.00am-1.00pm

Break

1.00pm-2.30pm

Session 2

2.30pm-4.49.59pm

Pre-Closing^

4.50pm-5.01.59pm

Post-Closing

5.02pm-5.15pm

Friday Pre-Opening*

9.45am-9.59.59am

Session 1

10.00am-12.30pm

Break

12.30pm-3.00pm

Session 2

3.00pm-4.49.59pm

Pre-Closing^

4.50pm-5.01.59pm

Post-Closing

5.02pm-5.15pm

*Order matching will take place from 9.58am to 9.59.59am.

^Random closing will take place from 4.58pm to 4.59.59pm and order matching will take place from 5.00pm to 5.01.59pm.

Kindly refer to the IDX Market information page for more details. -

16 May 2025

Important reminder to keep your trading account(s) safe

Recently, there have been news reports of hackers gaining access to trading accounts to manipulate stocks in a large-scale illicit trading spree. We assure you that, because of our robust security measures, this incident has not affected OCBC Securities or our customers.

Nonetheless, we want to take this opportunity to remind you to stay vigilant and take proactive steps to keep your trading account(s) safe. Here are some best practices:

- Do not allow others to access or use your account(s).

- Never disclose your personal details and sensitive information (e.g. your trading account password and portfolio amount) to anyone.

- Store the devices you use for 2FA (Two-Factor Authentication) in a safe location, or always keep them with you. This includes the mobile device that holds your digital tokens and receives SMS OTPs, as well as all hardware tokens.

- Be cautious of phishing emails, websites and mobile applications that may attempt to trick you into revealing your personal and sensitive information.

- Change your password(s) regularly.

- Inform us immediately if you notice any suspicious or fraudulent transactions made using your trading account(s).

-

09 May 2025

Revision in US SEC Fees Effective 14 May 2025

Please be informed that effective 14 May 2025, there is a revision in the US Securities and Exchange Commission (“SEC”) fees chargeable on a contract note for the sale of shares listed on US Stock Exchanges.

US SEC fees will be revised from 0.00278% to 0%. This new fee will apply to sell transactions executed on or after 13 May 2025, with settlement date on or after 14 May 2025.

You may refer to our Commission Rates and Charges for the updated fee charges.

If you have further questions or need assistance, do reach out to your Trading Representative. -

10 Apr 2025

Adjustment of Indonesia Stock Exchange (IDX) Rules on Auto Rejection and Temporary Halt on Securities Trading

Please be informed that effective 8 April 2025, IDX will be adjusting the rules on lower limit of Auto Rejection and Temporary Halt on Securities trading.

Adjusted Rules on Lower Limit of Auto Rejection

The lower limit of auto rejection will be adjusted to 15% and will apply to stock listed on the Main Board, Development Board, and New Economy Board, then on Exchange-Traded Fund (ETF), as well as Real Estate Investment Trust (DIRE) for all price ranges.

Adjusted Rules on Temporary Halt

In the event of a decline in IDX Composite (“IHSG”) in 1 Exchange Day, IDX can conduct actions as follows:

Event

Action Taken by IDX

If IHSG declines > 8%

Trading halt for 30 mins

If IHSG further declines > 15%

Trading halt for 30 mins

If IHSG further declines > 20% with the following conditions:

- Until the end of trading session; or

- More than 1 trading session after acquiring approval or instruction from Indonesia Financial Services Authority

Trading suspension

If you have further questions or need help, do reach out to your Trading Representative. -

28 Mar 2025

Revision of OCBC Securities Online Equities Account Terms and Conditions

The OCBC Securities Online Equities Account Terms and Conditions will be revised, changes as per below:

- Addition of new Clause 1(c)

- Addition of new Clause 3(e)

- Addition of new Clause 7(c)

- Deletion of original Clause 1(c) and Addition of new Clause 10

Changes will be effective on 28 April 2025. -

24 Mar 2025

Update on Financial Transaction Tax (FTT) for French Securities (Effective from Settlement Date of April 1, 2025)

The Financial Transaction Tax (FTT) applicable to the purchase of French securities listed on the French stock market will increase from 0.30% to 0.40%. This change will also apply to American Depository Receipts (ADRs) and Global Depository Receipts (GDRs) listed on the U.S. market that are backed by underlying French securities.

For transactions in the French market, this adjustment will take effect for trades executed on March 28, 2025.

In the U.S. market, the change will apply to trades executed on March 31, 2025.

We have updated our Commission Rates and Charges document accordingly. If you have any questions or require assistance, please contact your Trading Representative. -

27 Jan 2025

[Update] US Cannabis-related Securities Will No Longer be Supported by OSPL

In our announcement dated 9 December 2024, we notified you that OCBC Securities (“OSPL”) will no longer be supporting any trading of US Cannabis-related securities effective 20 January 2025.

Please be informed that this date has been revised from 20 January 2025 to 21 February 2025 to give you additional time to take action.

You will still be able to place any sell orders for these securities offline via your Trading Representative.

Alternatively, you may also choose to transfer-out these securities. Transfer-out fees will be waived. If any of these securities are not sold or transferred out by 21 February 2025, OSPL reserve the right to liquidate them or to take appropriate actions to ensure compliance with counterparty policies and exchange regulations.

If you have further questions or need assistance, you may reach out to your Trading Representative. -

10 Jan 2025

Changes to operating hours for Chinese New Year

The OCBC Securities Investors Hub and our customer service hotline will operate from 8.30am to 12.30pm on 28 January 2025 (Tuesday), the eve of Chinese New Year

We will not operate on 29 and 30 January 2025 (Wednesday and Thursday), which are public holidays.

If you have questions during these times, please refer to our frequently asked questions (OCBC Securities website > Support). Alternatively, email us at askocbcsec@ocbc.com

We wish you a happy Chinese New Year. -

02 Jan 2025

Early closure on 17 January 2025

The OCBC Securities Investors Hub will close at 3.30pm on 17 January 2025 (Friday) for a company event.

Our usual opening hours will resume on 20 January 2025 (Monday).

We apologise for any inconvenience. -

01 Jan 2025

[Update] Increase in Fees for Trades in the Indonesia Stock Exchange (IDX)

Please be informed that IDX has revised the Value Added Tax (VAT) rate calculation on 1 January 2025.

Following this revision, with effect from 1 January 2025, the IDX levy, KPEI fee & VAT will remain as 0.0477% (no change).

We have revised our Commission Rates and Charges document accordingly.

If you have further questions or need help, do reach out to your Trading Representative. -

31 Dec 2024

Reduced tax rate for the sale of shares from 1 January 2025 and delayed trading hours on 2 January 2025 on the Korea Exchange (KRX)

The tax rate for the sale of shares listed on the Korea Exchange (KRX) has been reduced on 1 January 2025. It is now 0.15% of the trading principal (previously 0.18%).

We have revised our Commission Rates and Charges document accordingly.

KRX will also be starting its regular trading session 1 hour later on 2 January 2025 (1 day only).

Here are the details (all times refer to the time in Singapore):

Usual trading hours

Delayed trading hours only on 2 Jan 2025

Regular trading session

8am to 2.30pm

9am to 2.30pm

If you have further questions or need help, do reach out to your Trading Representative. -

12 Dec 2024

Revision of OCBC Securities Standard Trading Terms and Conditions

The OCBC Securities Standard Trading Terms and Conditions have been revised on 12 December 2024 to include new Section A – Clauses 11(q) and 34, and revisions to Section A - Clauses 11(p) and 24. Changes will be effective on 13 January 2025.

View the revised terms and conditions.

Platforms

Products & Solutions

Accounts

Insights

Important Notices