Improve cash flow flexibility with Share Financing

Improve cash flow flexibility with Share Financing

In order to react to market news and seize opportunities, investors need to be able to access capital quickly. But what if your funds are tied up in other investments? Did you know that it’s possible to instantly unlock the value of your existing share portfolio and use it to buy new stocks? This is where OCBC Securities Share Financing comes in.

How it works

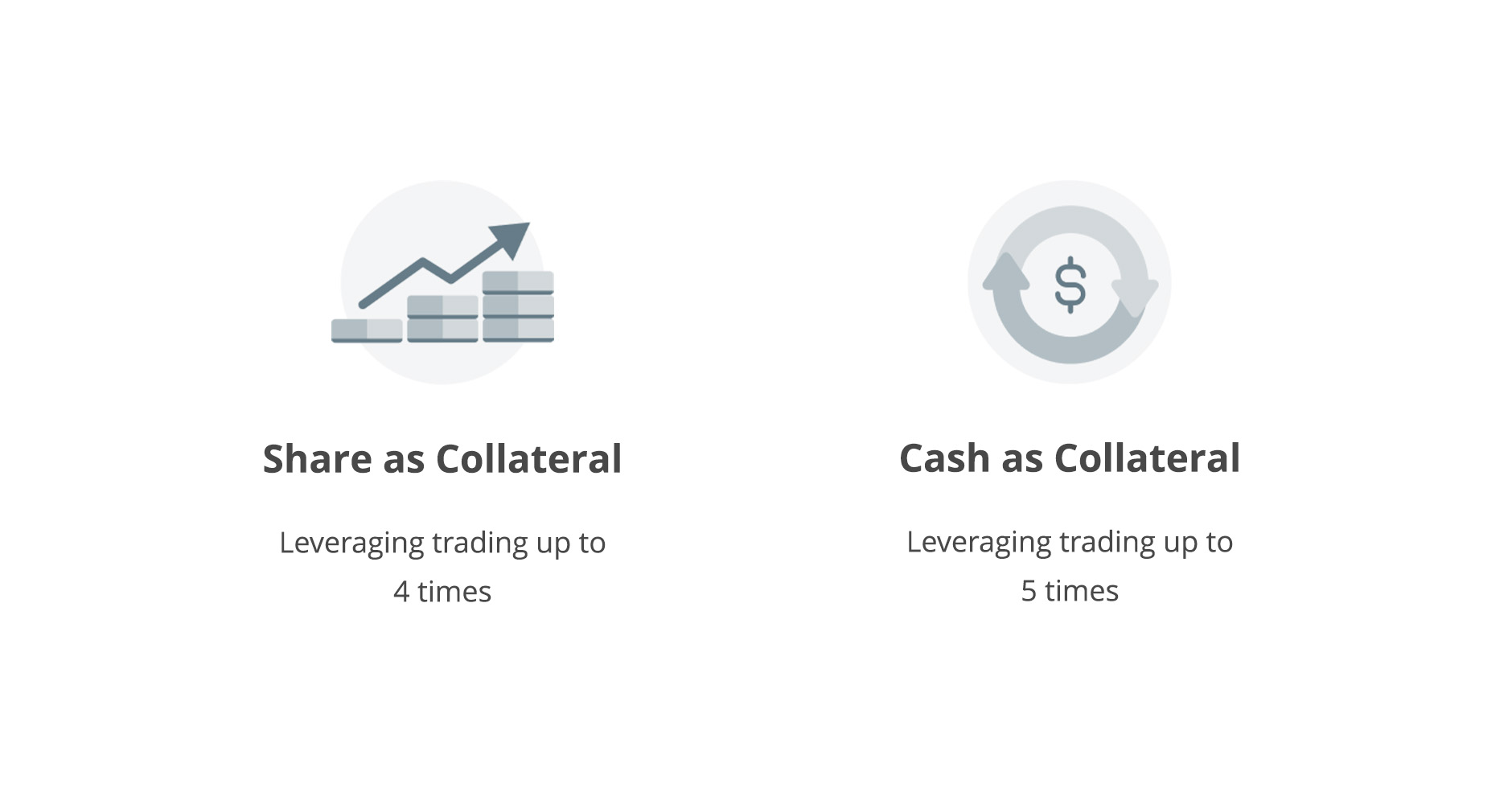

Investors can improve their cash flow flexibility by simply transferring their marginable securities to free up their asset value and increase their share buying power. When investors sell off the shares, the borrowed amount plus interest is paid back to OCBC Securities, and the remaining profit is yours to keep.

For instance, Customer A with S$1,000 cash can buy up to S$5,000 worth of shares with share financing (instead of the only S$1,000 worth of shares). If the price goes up by 10%, Customer A gets a S$500 profit (instead of S$100 profit).

Below is an example of a leveraged dividend investment strategy using the Quality Priced Loan+ (QPL+) feature (For illustration purposes only).

Customer A, who provides a cash deposit of S$50,000, purchases up to S$250,000 marginable value of securities as shown in the table below.

| MARKET | COUNTER NAME | GRADE | INDICATIVE DIVIDEND YIELD ANNUALIZED (%) | INDICATIVE DIVIDEND ANNUALIZED (S$) | Marginable Value (S$) |

| SG | Company ABC | 1 | 4.83% | 2,415 | 50,000 |

| US | Company DEF | 3 | 4.54% | 2,270 | 50,000 |

| HK | Company GHI | 3 | 5.06% | 2,530 | 50,000 |

| AU | Company JKL | 1 | 6.21% | 3,105 | 50,000 |

| MY | Company MNO | 1 | 7.61% | 3,805 | 50,000 |

| TOTAL | 14,125 | 250,000 | |||

The table below summarises the expected return Customer A would earn with and without the share financing facility. With the share financing facility, Customer A can expect to earn higher returns due to the lower initial outlay required for the investment.

|

|

Unlike other lending options such as a term loan, the OCBC Securities Share Financing account is a revolving credit facility. Investors have the freedom to borrow funds for 1 day to invest in their shares and pay back the loan the next day – only 1 day’s interest is charged, and there are no break fund costs (subject to terms and conditions). What’s more, as long as you maintain the required amount of equity in your OCBC Securities Share Financing account, you won't be held to any repayment schedule – there is no loan tenure, no regular principal + interest payment required.

Understanding margin call and margin percentage

Share financing is a form of leveraged trading, which can increase the profits in relation to the initial capital that is being invested. However, we all know the opposite can happen too. When trading on leverage, you are required to maintain a certain amount of equity in your margin account so that you always have a margin of safety in the portfolio.

A margin call occurs when the value of the investor’s margin account drops and fails to meet the account's maintenance margin requirement. An investor will need to sell positions or deposit funds or securities to meet the margin call.

If the value of your collateral falls, your portfolio margin ratio (Margin Ratio = Total Collateral Value/Loan Amount) will fall. When the margin ratio falls below 125%, your portfolio will be in margin call. You will need to regularise the portfolio to 125% by either liquidating shares or top up additional collaterals such as cash deposits or shares transfer into the margin portfolio.

| If Margin Ratio falls | What happens |

| Between 115% - 125% | Margin call to restore the margin percentage to 125% within 2 market days |

| Below 115% | Margin call to restore the margin percentage within the date of notice |

Trade beyond Singapore

OCBC Securities offers the widest range of marginable securities across 5 major markets. We accept over 3,000 listed securities in Singapore, Hong Kong, USA, Australia and Malaysia. The marginable securities span across many different asset classes, such as Company Shares, Real Estate Investment Trusts (REITS), Bonds, Exchange-Traded Funds (ETFs) and American Depository Receipts (ADRs).

Save on foreign exchange conversion costs

Our multi-currency share financing feature allows you to finance your trades in 4 different currencies, namely SGD, USD, HKD and AUD. This gives you the advantage to take up a loan, execute and settle your trades in multiple currencies thus reducing unnecessary foreign exchange conversion costs.

For example, if an investor has multiple shares in US or HK Markets or when USD interest rates are low, he or she could easily perform a loan switch between their HKD and USD loan with no break fund costs, and no loan switch costs.

Other benefits of OCBC Securities Share Financing

On top of buying listed shares, OCBC Securities Share Financing also allows you to utilise the loan facility for Initial Public Offerings (IPO) through IPO Financing.

For some of the corporate employees who have share options as part of their compensation package, OCBC Securities Share Financing also allows you to utilise the loan facility through Employee Share Option Financing (subject to terms and conditions). This is so that you do not have to come up with the full share options premium to subscribe for your Employee Share Option shares. Talk to your Trading Representative or contact us for more information.

Another benefit is our Quality Priced Loan+ (QPL+) feature, which gives you greater control over your share financing interest rates. QPL+ interest rates are charged according to the quality of the collateral in your investment portfolio. If you have high quality shares in your portfolio, you will enjoy a lower charge on your loan.

As an added benefit, you get to enjoy lower online commission rates across the 5 main markets. Terms and Conditions apply. Click here to find out more.

Risk warning for Share Financing

Borrowing to finance the trading of securities (leveraging/gearing) carries a high degree of risk. If the value of the collaterals declines substantially, falling below the maintenance margin requirement, you may be called upon to deposit substantial additional funds on short notice in order to maintain your position. If you fail to comply with a request for additional funds or reduce your loan within the specified time, your position may be liquidated at a loss and you will be liable for any resulting deficit in your account.

Customers should note that there are limitations and difficulties in using examples, tables or illustrations to provide a full explanation or depiction. All information, statements, figures, content, explanations, examples, and details (collectively, the “Information”) contained above is intended for illustrative and/or information purposes only and should not be relied upon for any purpose whatsoever. Customers should, in the event of any doubt as to how to read or understand the examples, tables, illustration or information, contact OCBC Securities Private Limited for a fuller explanation, depiction or further details.